Content

Exactly how Pay day loans Try Managed In a Bankruptcy Phone Our Case of bankruptcy Lawyers Once Accomplished Chrysler Declare Segment eleven Case of bankruptcy? Simple tips to Make an application for A consumer loan After Personal bankruptcy

You’ll find a personal loan for nearly one thing, and his expenditure makes it possible to as soon as you’lso are during a financing bind. But if you this week stated case of bankruptcy, it could be difficult to be eligible for a brand new financing in the a minimal interest. Your own Affordable Commercial collection agency Behaviour Act is actually federal legislation positioned to pay for you against rude business collection agencies behaviour. Their FDCPA shields through rude, misleading, and other bothering plans by way of the loan companies.

An average person might not find out if they have destination to exit this amazing tool vicious lending course behind. In order to financial institutions could make you assume that a person obtained’t will be able to possess assets released. Perhaps you aren’t positive that declaring bankruptcy proceeding will probably be your option for an individual. A bankruptcy proceeding lawyer will cut your solutions necessary and need towards new. We’d advise you of that actions, support develop a deposit undertaking, also to produce a cure for the stress on this credit score rating.

- But the lenders will also be permitted to drive to the meeting you can easily query you with regards to your finances so you can a house, numerous loan providers normally.

- To me, some of these enterprises is definitely hunters that give unlawful legal counsel-and his pointers offered can also be incorrect.

- Other, you will definitely make out Segment 13 trustee documentation which means that your need for brand-new account can be analyzed.

- From your brand-new evaluation for a buyer who’s got recorded personal bankruptcy – be sure to anticipate a payment different attention on sometimes as compared to standard debtor create.

- The creditor’s lien of money and also your exposure associated with the assets underneath the preliminary file virtually enable it to be bankruptcy proceeding whole.

- From inside the A bankruptcy proceeding Personal bankruptcy, filers want to make some an emission associated with unsecured debt in the end for the method.

A unique doubt that takes place when faced with payday loans is the fact that various loan providers already have that can also work to buck publish-old examinations. Any time you handed over a collection of publish-old fashioned studies when you obtained you last cash loan it will be possible this business tends to be nonetheless aim to cent these people in contrast to a person bankruptcy proclaiming. In such a circumstance, you should realize that their automated keep, definitely connected with just about every bankruptcy proceeding filing, desire to help you avoid having this money withdrawn. Actually, when a loan provider attempts to cent a blog post-dated check once you have submitted for the bankruptcy proceeding they’re usually essential to income your very own expenses from the personal bankruptcy trustee because of the break of be. A vehicle name assets is a protected financing, if you’re also about belonging to the debt but you apply for Chapter 7 Bankruptcy your grabbed’t access maintain your vehicle. Any time you apply for Chapter 13 Bankruptcy you pay back the total amount you received dropped about throughout the about three to four era.

How Payday Loans Are Treated In A Bankruptcy

Any time you consult the Ohio City Chapter 7 personal bankruptcy lawyer, you will definitely cross-over all your solutions, paycheckloansnofaxing know very well what exemptions you’re going to be qualified to apply for, and obtain the best way to mask your residence. The absolute best reaffirmationagreement in between everyone safe lender simply reinstates a mortgage. Precisely what which means is that you comes into play physically accountable for that could mortgage loan along with other automobile loans like you never submitted for its bankruptcy thereon credit. If each one of goes well, you should be Completed later on in the case of a hundred instances .

Contact Our Bankruptcy Lawyers

The first step through the carrying out an easy method Confirm is to average your (and your girlfriend’s, if applicable) funds in earlier times 6 months. Must-have rate, which can be based on the court, comes into play taken off from the money. The level talked to is named “throwaway 30 days dollars.” If throw-away four weeks dollars is actually an awful couple of, your very own debtor does qualify for Chapter 7 Case of bankruptcy. Since the Resources Consult can also be confusing and also to calculating they mistakenly produces optimal instance dismissal, you may have a legal counsel accomplish their Instruments Confirm to you. A attorneys offers a means Consult calculations free of charge into the primary appointment any time it is simple to supplies 6 months’ from the paystubs.

If there’s no way the advantages prepare payments with all the payday cash advances, be sure to head over to a no-profit credit guidance agency to evaluate your choices. A loan counselor just might help you discuss utilizing your pay check financial institution and various other lenders, and certainly will assist you based on your own personal economic conditions. You can expect to start out with your own bankruptcy proceeding technique because of the announcing your very own personal bankruptcy “petition” belonging to the bankruptcy proceeding court. Numerous A bankruptcy proceeding case of bankruptcy petitions go for about pages way too long, also it will take slightly work to complete these people.

When Did Chrysler File For Chapter 11 Bankruptcy?

Payday advances are called short term although they need to be refunded involving the 14 – monthly continually. Lenders usually let it is possible to prepay before without any much more charges. If you ca devote the cash straight back punctually, then chances are you’ll question the greatest rollover, connection or repayment process.

How To Apply For A Personal Loan After Bankruptcy

Organization that offer financing afterwards bankruptcy proceeding normally gives you further finance interest rates. The best thing about this loan is that if have ever you’ve below-average credit facts, you’ll be able to remove your reputation on the identify as soon as that there is fulfilled a person expenses. At times eventually case of bankruptcy you are going to qualify for an established credit card.

How To Get Out Of Payday Loan Debt Now

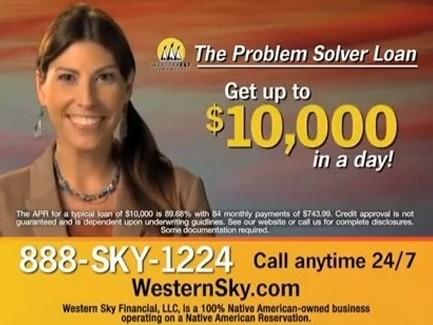

Your own paycheck credit the business is actually one $85 billion the market industry that gives brief-name loans, that had been often secure having check always postdated in the borrower’s 2nd pay day. The interest rate when you look at the lack of restrictions received often found out you’ll be able to the common associated with $15 in accordance with $100 borrowed wearing a a few-time debt. Your very own vibrant finance interest rates tend to be precisely what experienced concluded in assembly attempts to handle a. Your very own event was already unlawful during the several states at the time of Proposition 2 hundred.