Relevant Definitions

- JPMorgan Chase Financial

- Wachovia Bank

- Financial out of America

- L/C Lender

- KeyBank

- Bangladesh Lender

- UBS AG, Nyc Branch

- Wachovia

- Union Lender

Into the , the fresh Section of Columbia sued Intensify, in which Republic Lender & Faith and you will FinWise Financial plan, having violating their interest limit.124 Contained in this area, we focus on the really egregious types of lenders and work out funds far in excess of thirty six%.

The brand new Debtor use the arises from this new sales of each Mention only (i) to invest in contribution passions inside the financing and you can focus receivables (in any low-pay day loan tool), got its start by FinWise Financial, (ii) to fund particular costs and costs associated with new consummation of the brand new deals contemplated from this Arrangement, and you can (iii) at the mercy of excess accessibility not as much as so it facility, to transfer funds just like the allowed below so it Agreement.

As to what we are able to give, FinWise Lender, Republic Bank & Trust, and CCBank are not providing the financing that we provides explained during these comments as a result of its minimal level of branches otherwise on the their particular websites.

Republic Bank & Trust (Kentucky-chartered) and you may FinWise Bank (Utah-chartered) was permitting three high- costs loan providers, OppLoans, Intensify, and Enova, generate payment funds or lines of credit in excess of 100% Annual percentage rate inside the a maximum of at the least 31 claims who do perhaps not create including high rates.145 OppLoans also provides $500 to $4,100 payment money courtesy FinWise Bank at the 160% Annual percentage rate from inside the 24 states that don’t create you to rate.146 FinWise carries the brand new receivables returning to OppLoans or a related entity.

Musselman, Spouse, Hudson Plan, LLP, Washington, DCDavid Tilis, Vp, Movie director away from Specialty Credit, FinWise Bank, Backyard City, New york Breakdown from Committee:FinTech while the a promising issue enjoys controlled the news over the recent years.

As well, FinWise Lender is even doing work in partnerships along with other extremely high-pricing lenders for example American Very first Money but it’s perhaps not clear if your funds is actually evading state interest rate restrictions.

FinWise Bank first provides every resource  , retains cuatro% of your stability of all loans got its start and sells the remainder 96% financing contribution when it comes to those Go up cost finance so you’re able to an authorized SPV, EF SPV, Ltd.

, retains cuatro% of your stability of all loans got its start and sells the remainder 96% financing contribution when it comes to those Go up cost finance so you’re able to an authorized SPV, EF SPV, Ltd.

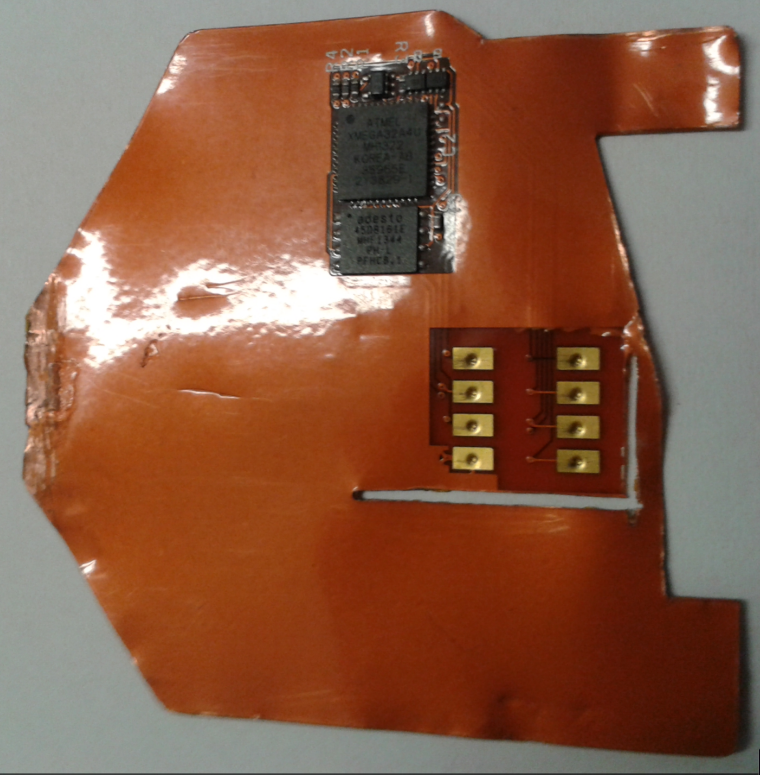

The second screenshots come from the bank’s website one now directories these lenders certainly the Proper Partnerships:55 Opploans makes financing in direct claims in which higher-cost credit are enabled however, uses FinWise Lender during the claims where they are certainly not.

Similar to the connection with FinWise Lender, CCB first brings the resource, holds 5% of balances of the many funds started and you may sells the rest 95% loan involvement when it comes to those Go up payment fund in order to a 3rd-team SPV, EC SPV, Ltd.

Associated with FinWise Financial

L/C Lender means the original L/C Bank and just about every other Bank that has been designated due to the fact an enthusiastic L/C Financial according to Condition 5.11 (Conference and alter off L/C Financial) and you can which has not retired according to section (c) away from Clause 5.eleven (Fulfilling and change of L/C Financial).

Bangladesh Financial mode the bank centered lower than Article step three of your Bangladesh Financial Order, 1972 (P.O. No. 127 off 1972) with regards to carrying on the business of your own main financial and get comes with its successors;

Bank You to setting Bank You to, NA, a nationwide financial organization having its dominant office in the il, Illinois, with its individual ability, as well as successors.

Eye bank means a person that is actually signed up, certified, otherwise controlled significantly less than government or condition law to take part in the fresh healing, assessment, analysis, running, stores, or shipment regarding people sight otherwise portions of individual attention.

Electronic Financial (a) function the introduce and you can future on line financial functions and that’s utilized thanks to 365 On line, and Lender out of Ireland Cellular Financial; and you can (b) boasts a regard to 365 On the internet and/or Bank of Ireland Mobile Financial in which that produces experience.

Uk Low-Lender Bank means where a loan provider becomes a party after the big date on what that it Arrangement is actually inserted on, a loan provider which provides a taxation Verification throughout the Task Agreement or Transfer Certification it executes towards the getting a party.

Worldwide financial business means a global standard bank at which the newest United states was an associate and whose bonds are excused regarding registration underneath the Bonds Act from 1933.